When you lose a loved one, the last thing you want to deal with is a ticking clock on their real estate. Yet, one of the most common questions I get from heirs and executors is simply: How long do I actually have?

The short answer is that, generally speaking, there is no federal law demanding you sell an inherited home within a specific number of days. The government isn’t standing over your shoulder with a stopwatch the moment the will is read. However, simply saying “there’s no deadline” is dangerous advice because financial pressures and lender rules create their own effective timelines.

While you might not face a legal statutory deadline, you are likely facing financial ones. Between probate requirements, tax implications, and the unique rules of reverse mortgages, waiting too long can cost the estate thousands of dollars. Let’s break down the real timelines you need to know, moving from the legal side to the financial reality.

The Probate Process: The First Timeline to Watch

Before you even worry about when you must sell, you have to determine when you can sell. For most families, the house is tied up in probate, which acts as a mandatory holding period before a sale can officially close.

Generally, you cannot list or close on the property until the court officially appoints an executor or personal representative. Depending on where the property is located and how complex the estate is, this legal administrative phase can drag on anywhere from 6 to 24 months. During this time, the house is essentially in legal limbo. It is possible to sell a house while probate is still open, but it usually requires specific court approval or an executor with “full authority” granted by the will. If you delay starting the probate process, you are just pushing back the date when the asset can be liquidated. The consequences of delay here aren’t usually penalties, but rather the slow bleed of the estate’s value through ongoing fees while the house sits unmarketable.

The Exception: Inheriting a House with a Reverse Mortgage

If your parent or relative had a reverse mortgage (specifically a Home Equity Conversion Mortgage or HECM), you need to stop reading the general advice and pay attention to this section. This is the one scenario where there is a strict, hard deadline.

With a reverse mortgage, the loan becomes “Due and Payable” immediately upon the borrower’s death. The lender doesn’t wait around. Here is the standard timeline you are up against:

- 30 Days: You typically have about one month to notify the lender of the death and declare your intent (whether you plan to sell the home, buy it yourself, or walk away).

- 6 Months: This is the standard deadline to settle the debt. You usually must sell the home or refinance it to pay off the reverse mortgage balance within this window.

- Extensions: If you are actively listing the home and can prove it (usually by showing a listing agreement with a real estate agent), HUD guidelines may allow the lender to grant you two 3-month extensions. This caps your total time at 12 months.

If you miss these deadlines, the lender has the right to initiate foreclosure proceedings immediately. If you are handling a reverse mortgage inheritance, speed is not optional—it is a requirement.

Tax Implications of Waiting to Sell

For properties owned free and clear, the pressure to sell usually comes from the IRS rules regarding capital gains. The good news is that the tax code is actually quite friendly to heirs, provided you don’t wait too long.

When you inherit a property, you receive a Step-up in Basis. This means the IRS views the value of the home not as what your parents paid for it in 1980, but what it was worth on the day they died (Fair Market Value). If the house was bought for $50K and was worth $500K when they passed, your tax basis is $500K. If you sell it immediately for $500K, you owe zero capital gains tax.

The “cost of waiting” kicks in if the market moves:

- If the value rises: If you wait two years and the house appreciates from $500K to $550K, you will owe capital gains taxes on that $50K of new growth.

- Long-Term Status: There is a common myth that you have to hold the property for a year to get lower tax rates. That is false. The IRS automatically treats inherited property as long-term capital gains, even if you sell it two weeks after inheriting it.

Essentially, time is money. The longer you hold the property in a rising market, the larger your potential tax bill becomes.

Hidden Costs of Holding Inherited Real Estate

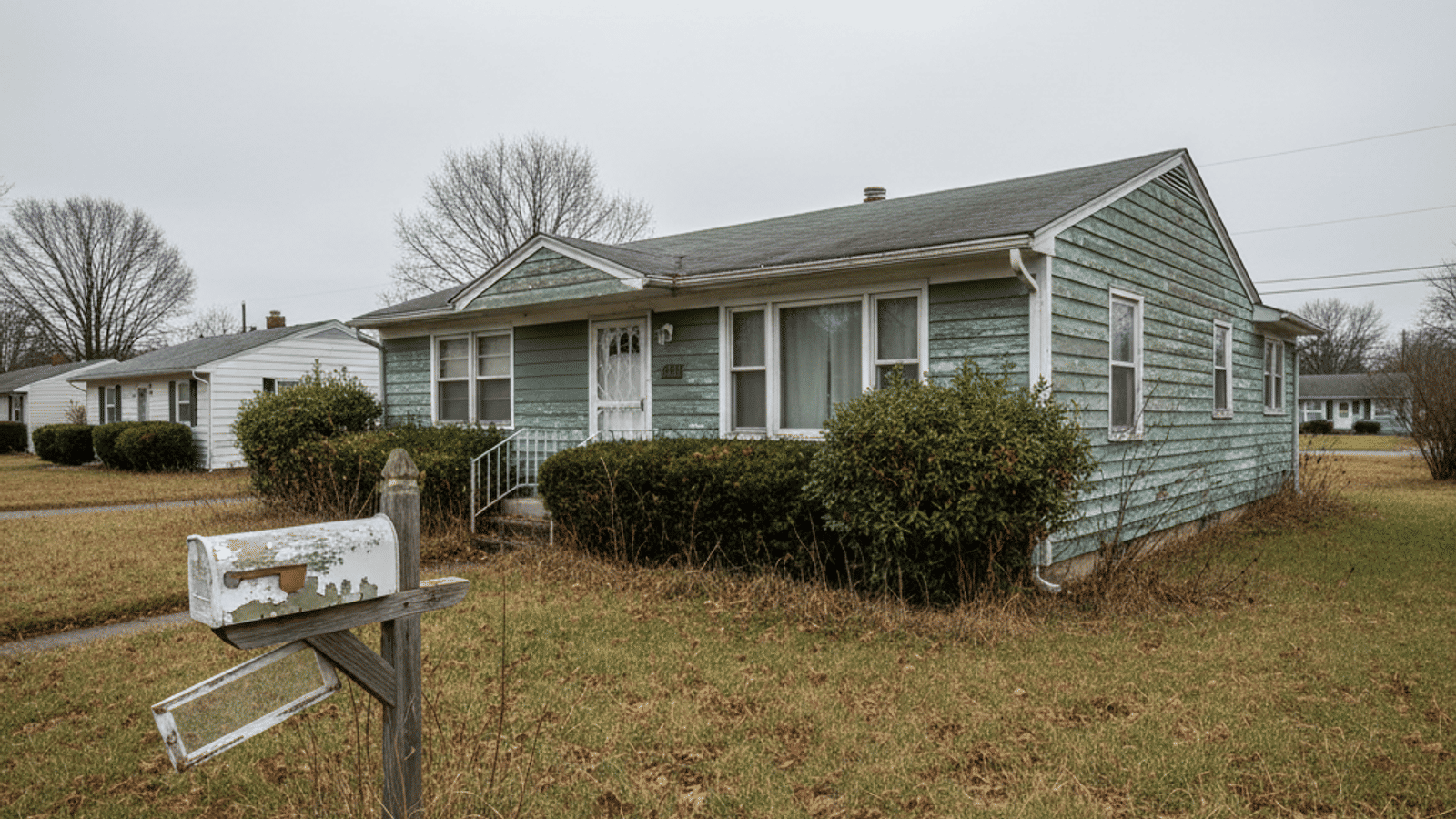

Beyond taxes and loans, there is the practical drain on your wallet. A vacant house is expensive. I often sit down with families who want to “wait for the right time” to sell, only to realize that the holding costs are eating up their inheritance.

- Insurance Risks: This is a big one. Most standard homeowner’s insurance policies have a clause that voids coverage if the home is vacant for more than 30 or 60 days. You often need to purchase a specialized “vacant home insurance” policy, which can be significantly more expensive than standard coverage.

- Utilities and Maintenance: You still have to heat and cool the home to prevent mold or frozen pipes. You still have to pay property taxes.

- Depreciation: An older home that sits empty tends to deteriorate quickly. Leaks go unnoticed, and the style feels more dated as new inventory hits the market.

From a budgeting standpoint, holding a vacant home usually costs hundreds, if not thousands, of dollars a month. Selling sooner stops the bleeding.

Multiple Heirs: When Family Disagreements Cause Delays

Sometimes the delay isn’t about the market or the law; it’s about the people. When multiple siblings inherit a property, disagreements can stall the sale indefinitely.

If one beneficiary wants to sell and another wants to keep the house as a rental, you can hit a stalemate. Unless the executor has been given independent authority to act, many states require unanimous consent for major decisions.

If the fighting drags on, you might face:

- Buyouts: One heir refinancing the home to pay the others their share of the equity.

- Partition Actions: This is the legal “nuclear option” where one heir sues to force the sale of the property. It is expensive, time-consuming, and usually drains a massive chunk of the estate’s value in legal fees.

Mediation is almost always a faster and cheaper route than litigation. If the family cannot agree, the house sits, taxes accrue, and the asset loses value.

Does My State Have Specific Deadlines?

While we’ve covered federal tax rules and lender timelines, you might be wondering if your specific state has a “sell-by” date.

Most states do not have a statute that explicitly says, “You must sell inherited real estate within X months.” However, probate judges do have patience limits. If the estate has outstanding debts to creditors—credit cards, medical bills, or Medicaid recovery claims—a judge can and will order the executor to liquidate assets to pay those bills.

If the estate is solvent (has more assets than debts), the court is generally more lenient about how long you take, provided the executor is acting in the best interest of the beneficiaries. Always consult a local probate attorney or a real estate professional familiar with your local court system to ensure you aren’t violating local procedural rules.

Frequently Asked Questions

No, the Section 121 exclusion (which allows you to exclude $250K or $500K of gains) generally requires you to live in the home for two of the last five years. Simply inheriting the home does not qualify you for this exclusion unless you move in and make it your primary residence for at least two years before selling.

It depends on the terms of the will and the probate court’s ruling. If the executor has been granted “full authority” under the Independent Administration of Estates Act (or local equivalent), they can often sell without specific beneficiary sign-off, though they usually must provide notice.

You risk significant financial loss. Aside from ongoing property taxes and insurance costs, the home may deteriorate physically, reducing its value. Furthermore, if the home appreciates in value during those years, you will owe capital gains tax on the difference between the value at the time of death and the eventual sale price.

No. The IRS offers a special exception for inherited property. It is automatically treated as a long-term holding, regardless of how quickly you sell it. This means you qualify for the favorable long-term capital gains tax rates (0%, 15%, or 20%) rather than the higher short-term ordinary income rates.